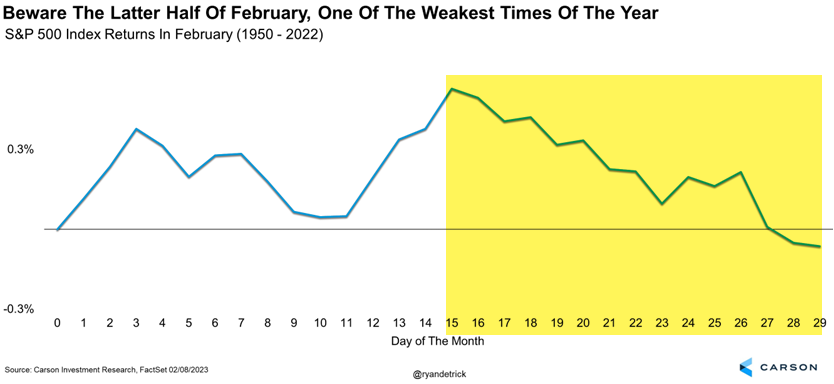

It has been a great start to 2023 for stocks. We continue to expect higher prices this year, but we don’t anticipate they’ll happen in a straight line. February is sometimes known as a hangover month, and we wouldn’t be too surprised if stocks had a small break during this historically troublesome period.

- Stocks still look very strong, but February can be a tricky month.

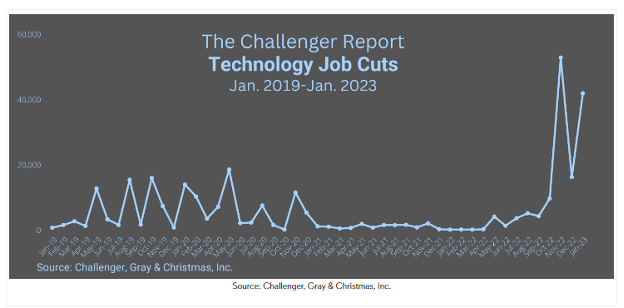

- Technology company layoffs have dominated headlines, prompting renewed recession fears.

- Tech firms may simply be retrenching after a torrid pace of hiring over the past decade.

- The good news is the rest of the economy may be picking up the slack.

In fact, September and February are the only months that have averaged negative returns since 1950. More recently, over the past 20 years, stocks have fallen in February. Now here’s the catch — most of the weakness in February occurs later in the month. So, starting this week and going into March, be aware stocks historically have taken a well-deserved break, and this could happen again in 2023. However, any potential pullbacks could offer opportunities for investors.

Putting the Tech Layoffs in Perspective

It’s hard to get away from all the headlines about layoffs in the technology sector. Most recently, Yahoo announced it was laying off 20% of its workforce, about 1,600 people.

The firm Challenger, Gray & Christmas, Inc. tracks layoff announcements, and its most recent report was titled “Jan ’23 Recession or Correction?”. The firm reported that the tech sector announced cuts of 41,829 in January, which amounted to 41% of all announced layoffs. That was the second highest for the sector on record and represented a massive 158% increase over the 16,193 announced in December. Contrast that to January 2022, when there were just 72 announced layoffs in the sector.

Between November 2021 and January 2022, tech sector layoff announcements have totaled 110,793.

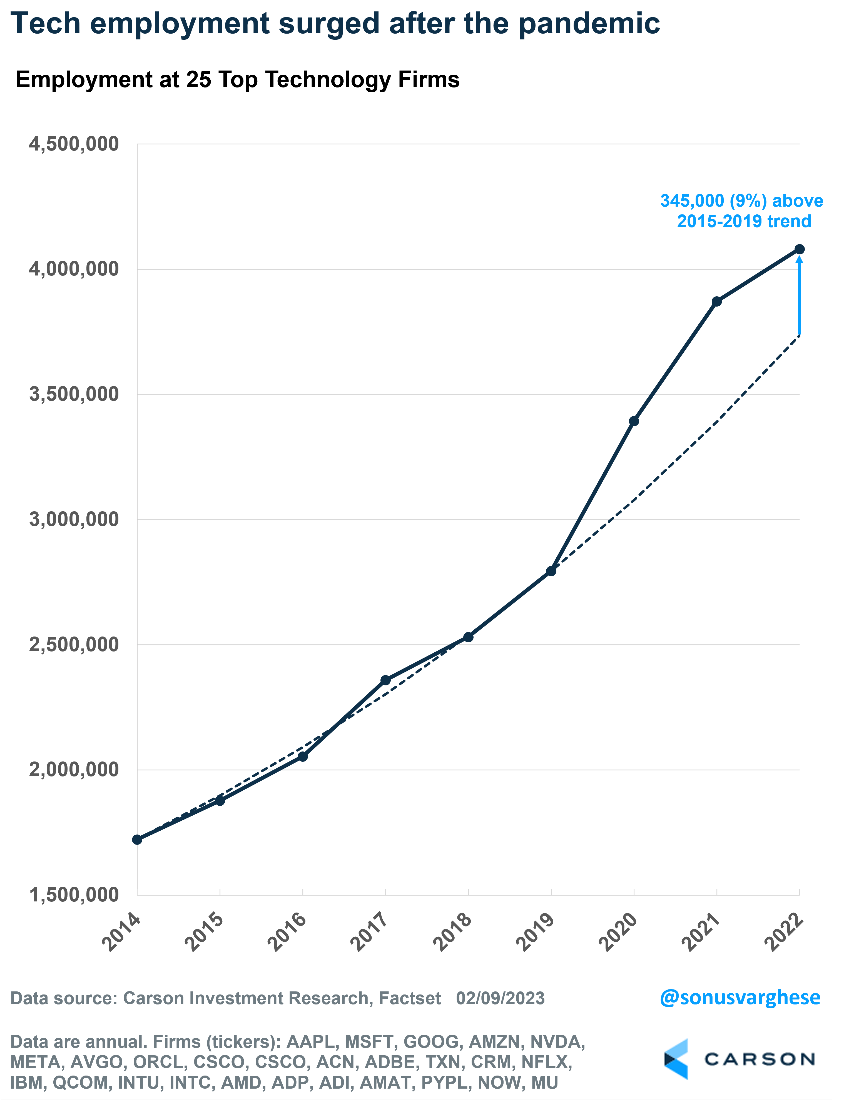

Tech Went on a Hiring Spree Over the Last Decade

We reviewed employment in 25 top technology firms that represent about 25% of the S&P 500 index. Total employment at these firms grew at a torrid 10% annual pace between 2015 and 2019. That pace surged after the pandemic hit. By the end of 2022, employment at these firms was 9% above the already-hot pre-pandemic trend! That translates to about 345,000 more jobs than would have been expected if hiring remained on trend.

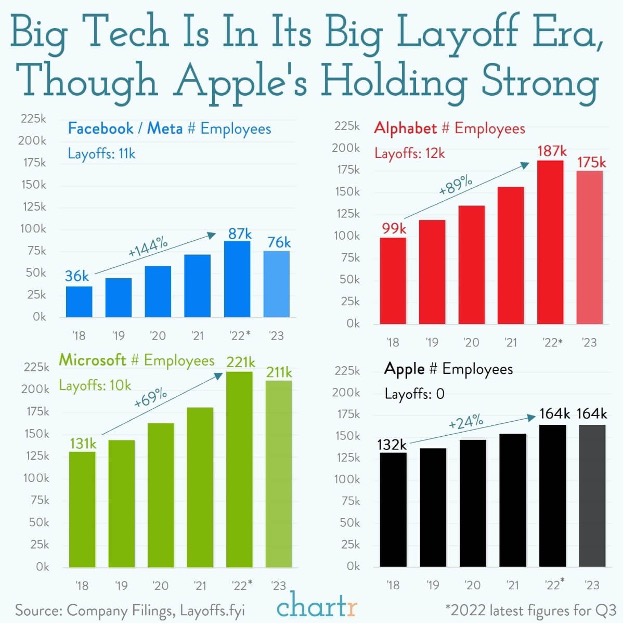

Here’s a look at the top four: Apple, Microsoft, Alphabet, and Meta.

Perhaps it shouldn’t be surprising that these companies are now retrenching.

A Sharp Contrast to the Rest of the Economy

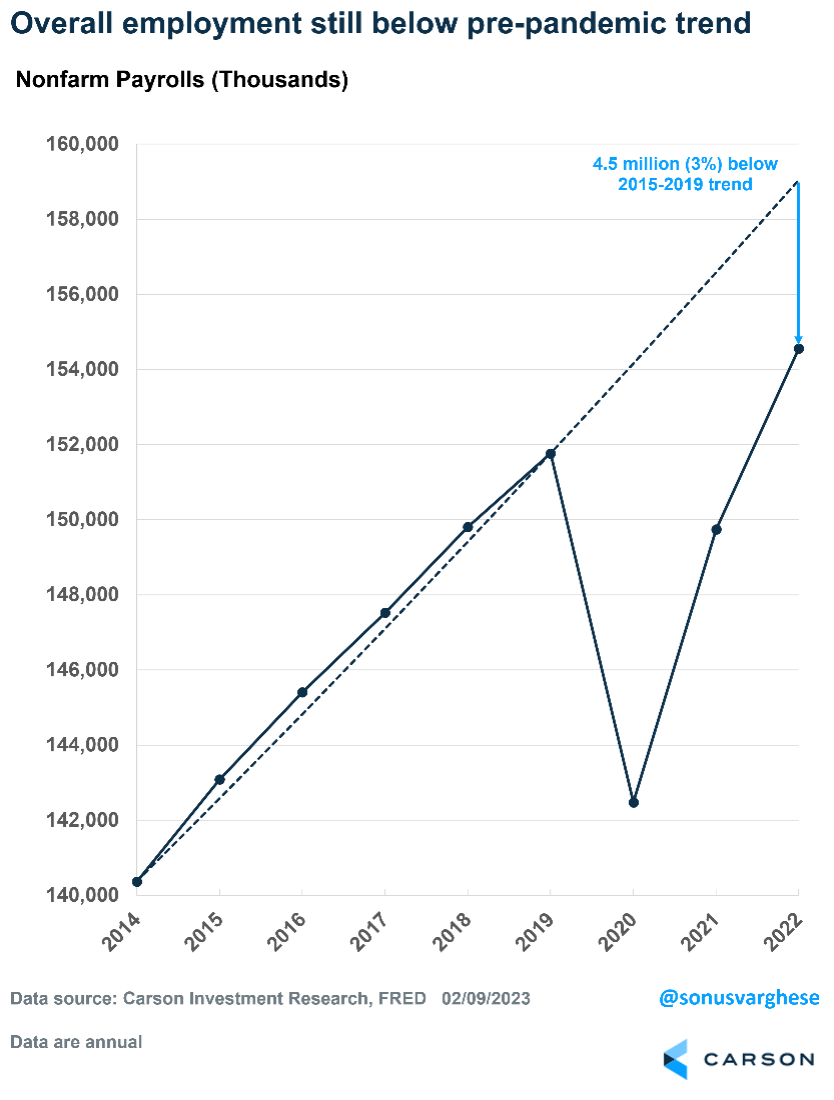

The rapid growth rate of employment across the 25 tech firms we reviewed contrasted with the annual job creation pace of 1.6% across the entire economy (which is not terribly shabby) during that period.

Then the pandemic hit, and the economy saw massive job losses even as tech companies boosted hiring even more. It’s important to note the last two years were amongst the best on record with respect to economy-wide job creation, with 7.3 million net jobs created in 2021 and 4.8 million in 2022.

Yet, employment remains 3% below the pre-pandemic trend. That translates to 4.5 million fewer jobs than would have been expected if the pandemic hadn’t hit.

Layoffs are Common, Even When Hiring is Strong

The tech sector looms so large in our minds, which is why tech layoff announcements make headlines and prompt renewed recession fears. However, layoffs number more than a million each month across the entire economy. Just in December, the Bureau of Labor Statistics reported 1.47 million layoffs. Across 2022, employers laid off about 17 million workers!

At the same time, the BLS estimated net employment rose by 4.8 million in 2022, the second-best year on record for job creation since 1940.

So, keep in mind that when companies announce layoffs, they’re not indicating whether these are “net,” as in whether these layoffs are net of other hiring or whether they’ve frozen hiring altogether.

The good news is the employment market looks really strong even as the tech sector reverses its recent hiring spree.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Compliance Case # 01656477